By now, most marketers working in the China market will be aware of the massive potential for brands in blockbuster e-commerce events like Alibaba’s Singles’ Day (11 November) or Double Twelve (12 December). A 2018 study by Nielsen found that a whopping 94 per-cent of online consumers in China had bought something during Singles’ Day sales. Meanwhile, 81 per-cent of those surveyed said that they were interested in purchasing imported brands, proving that brands have to be on their A-game for China’s e-commerce shopping festivals.

Many brands analyse their data and returns from these e-commerce festivals with a fine tooth comb. There is little time for marketers to dwell on 2019’s successes and failures though—the new year is underway, and the big sales opportunities for Chinese New Year and Valentine’s Day are just around the corner. Let’s take a look at how China’s major e-commerce platforms approach these festivals, and what are some of the best practices brands can implement.

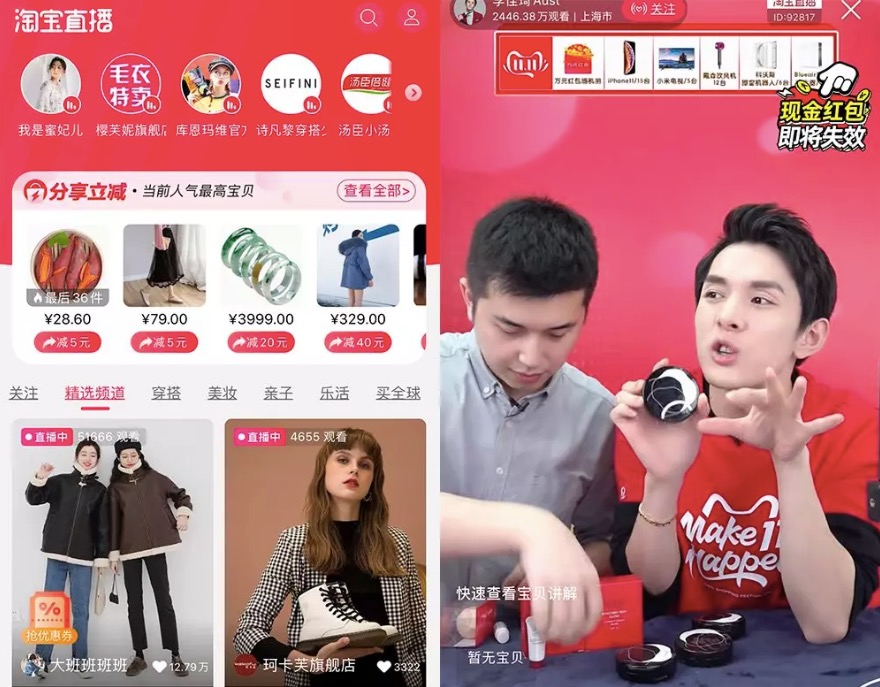

Taobao

Taobao remains the world’s biggest e-commerce platform, and all brands should pay attention to Taobao’s initiatives and functionalities, as well as study how Chinese consumers engage with the platform. This is especially true around the big e-commerce shopping festivals like Singles’ Day and Double Twelve.

Like other major e-commerce platforms, Taobao has taken to hosting a blockbuster live broadcast to kick off shopping festivals like Singles’ Day and Double Twelve. The slogan for Taobao’s 2019 Double Twelve live broadcast was a promise that “everyone is a live streamer and everything can be live-streamed.” Live broadcasts don’t have to focus on products and they don’t have to be hosted in a conventional studio—brands should be creative and ask where their audiences expect them to be.

Another highlight on Taobao has been the rise of head-to-head match-ups between KOLs. Live streamers can use a split-screen to develop discussion themes and create contests, with followers streaming the event in real-time. This year, Taobao used these match-ups to create opportunities for mid-level live streamers to showcase their talents. Competition winners were rewarded with the opportunity to share a split-screen with a top live streamer in the evening.

Tmall

Whereas Taobao is focused more on domestic vendors and brands, its sister platform, Tmall, is Alibaba’s e-commerce hub for international brands.

Singles’ Day is Tmall’s biggest day of the year, and the platform is often the place to look for the stories that grab the headlines. For example, it was Tmall that made Kim Kardashian’s joint appearance with live streaming superstar Viya during Singles’ Day 2019 possible. Kardashian’s live stream with Viya promoting her KKW fragrance was a highlight of Singles’ Day 2019.

Jingdong (JD.com)

JD.com started out specialising in e-commerce through electronics and home appliances, and that’s still a major part of the platform’s focus, but today the platform’s range is much broader.

As well as participating in other e-commerce festivals like Singles’ Day and Double Twelve, JD.com holds its own “6.18” festival in early June each year to mark the anniversary of the company’s founding. The event is second only to Singles’ Day in terms of sales volume, with consumers dropping a record of $29.2bn during the 2019 edition. JD.com reported that the results were driven by significant growth in sales in lower-tier cities.

Recognising the event’s growing importance and keen to take advantage of the spike in consumer activity, Alibaba-owned Taobao and Tmall also host their own 6.18 events, though not always on 18 June itself (in 2019, they marked the festival on 1 June). Apple participated for the first time in 2019, via Tmall.

In November 2019, JD.com announced an upgrade of its cross-border e-commerce service to integrate its cross-border service with its global import business. As part of the rollout, the company launched JD International, intended as a user-friendly, integrated one-stop-shop for imported goods.

Suning

The one-time brick-and-mortar electronics retailer has successfully transitioned to e-commerce, now offering a full range of goods from sportswear and furniture to food and second-hand cars.

Suning’s flagship e-commerce event is its own 8.18 festival, held on 18 August. The company claimed it shipped over RMB 1bn worth of home appliances and “3C” goods (computers, telecommunications goods and consumer electronics) in just a minute and 28 seconds during the 2019 sale.

Suning runs major discounts through all e-commerce festivals, including international events such as Black Friday through its Suning International network. Suning’s 41 Laox brick-and-mortar stores were fully integrated into last year’s Black Friday sales to ensure goods were available both online and offline. The company has also joined in with other platforms in hosting live-streamed shows to coincide with e-commerce festivals and promote its top deals.

Pinduoduo

Discount group buying platform Pinduoduo is still a relative newcomer compared to the likes of Taobao, but in terms of daily active users, the Tencent-backed platform has now displaced JD.com as China’s second-largest e-commerce provider, though JD still tops Pinduoduo in sales volume.

One advantage the platform enjoys is that consumers can access Pinduoduo’s deals through the WeChat app, an outlet that has been denied to Alibaba products. Pinduoduo’s growth has been driven largely by competitive pricing on everyday items like groceries and household products. For bigger-ticket items or those where the branding may matter more to consumers, they are more likely to use Tmall, even if that means paying a higher price, but for the everyday items, Pinduoduo’s discounts are highly attractive.

In the past, Pinduoduo has played down the importance of China’s e-commerce shopping festivals like Singles’ Day, but the platform still participates, and last year it ran diverse events including a 12-day agricultural products festival and its own six-day Black Friday sale, establishing outposts in the US, UK, Germany, and Japan to handle transactions and deliveries.

So how should marketers prepare for e-commerce festivals?

-

Use KOLs to spread the news and seed consumers in advance.

Many consumers started preparing their shopping plans two months ago, so only merchants who are well-prepared and generate buzz in advance can get into consumers’ minds and onto their lists of planned purchases.

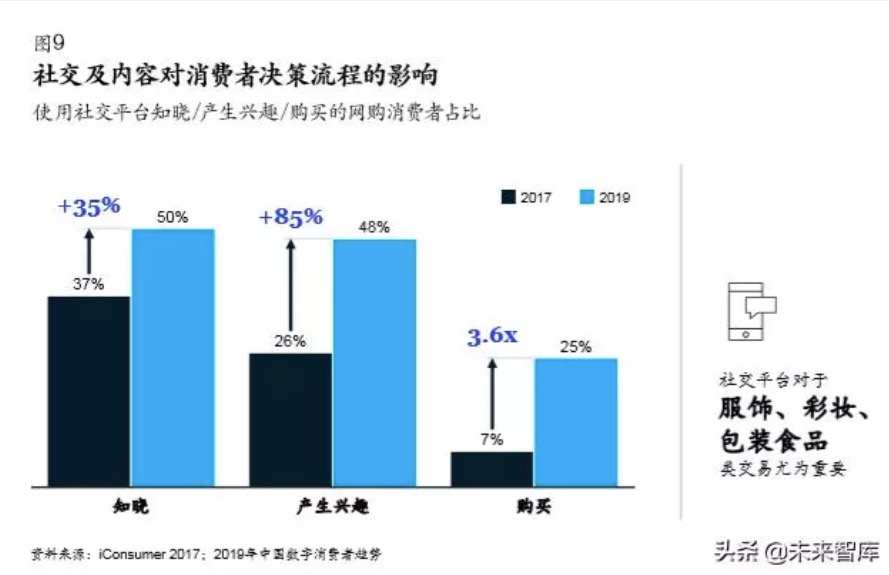

For example, before the promotion starts, create a gif or video for the product, combine with the KOL that matches the brand positioning, and promote it through social media accounts (Weibo, Douyin, Xiaohongshu, etc). It’s worth noting that flagship product should be selected for promotion, so it is necessary to research in advance on social media which products are suitable for promotion on such platforms.

Use bloggers to create advance interest in the products, and let users participate in your event immediately. On the day of the event, consumers will “queue” in your online store to make purchases.

-

Increase promotional budgets

During consumer e-commerce festivals, marketing departments should raise their budgets to gain more market buzz because cost-per-click costs during this period are typically higher than usual. By increasing your promotional budget, you can attract far more potential customers, while large discounts will help you attract customers at the right price.

E-commerce festivals can be said to concentrate all traffic on a certain platform on a given day, and then use price advantages to drive the urge to spend. So to a certain extent, e-commerce festivals are also a battle for traffic between many businesses and platforms.

The higher traffic cost is also due to the increasing number of competitors in each category, but there is only so much traffic, and everyone is fighting for it, so the cost of investing in promotions will by necessity be higher.

-

Don’t forget lower-tier cities when it comes to working with KOLs

Beijing, Shanghai and the other metropolises are still important, but China’s second- and third-tier cities are where much of the growth in e-commerce is taking place. In part, this is because large cities like Xi’an, Kunming and Zhengzhou still lag behind the top-tier cities in terms of prestigious mall developments and brick-and-mortar stores. Perhaps more importantly, e-commerce platforms are learning how to go beyond the big cities. Pinduoduo has successfully galvanised consumers in smaller cities and rural areas with its social commerce model, and Alibaba and JD.com have entered the fray with rival apps competing for these consumers. Alibaba even held an e-commerce festival, “Super Bargain Day”, in September last year specifically to offer generous discounts and group deals.

-

Follow these general marketing strategies for peak shopping periods

Create a countdown page. A merchant can create an event countdown page on its own store page, and send it to users with promotional information by email, text message, etc, and attach a discount link. The “countdown” approach can inspire a sense of anticipation and urgency among users.

Use content such as “limited time offers” to create a sense of urgency. Note: a genuine limited-time offer should not offer a discount of less than 50 percent.

Bulk order promotions. Consumers are encouraged to order in bulk to enjoy greater discounts. Packages, gifts, bundled sales and other forms of promotion should all be considered.

Offline pick-up (suitable for sellers with websites and offline stores). The convenient shopping experience of “online ordering and offline pick-up” provides consumers with additional discounts in order to reduce logistics and transportation costs.

No matter which strategy the brand opts for, it’s important to remember that the discounts and promotions should be consistent across all channels.

-

Develop marketing strategies through big data platforms

Many brands are confused when they participate in China’s e-commerce shopping festivals. They only know they want to launch a discount campaign frantically, but then these events may not necessarily bring the expected sales and profits.

This is why it’s crucial that during this time, brands study how their competitors are marketing themselves for the e-commerce festival. They should research what kind of brand messages and discount information is being spread on social media and which KOLs are talking about the brand during this time period.

Then it’s time for some self-reflection. Consider how is your brand performing on social media? Which KOLs are interested in your brand and have mentioned you? What do your competitors’ consumer interactions on social media look like? How much media value is being generated?

When a brand comes across a KOL they like, how do they know if they’re a suitable fit? They may be wondering how they can obtain this information from their content, historical data, interaction with fans, and brands they have worked with.

PARKLU can help! PARKLU’s proprietary technology platform uses multiple indicators and two-way analysis to find, match, recommend and predict KOLs that are consistent with brand marketing goals for brands, helping brands save 60% of their time. At the same time, PARKLU’s data reports can provide sufficient data such as market volume and competitive product analysis to help brand owners obtain one-stop KOL marketing solutions.

PARKLU’s database has more than 90,000 KOLs from ten social media platforms, covering fashion, beauty, food, travel, parent-child, fitness and other fields, covering more than 900 million Chinese users.

To date, PARKLU has served more than 8,000 brand owners and advertising / PR companies, including international brands such as Apple, Unilever, Estee Lauder, Booking and NBA.

Start the year off right as the e-commerce festival season is about to go in full swing!

Leave A Comment