As the year ends, what results have you seen from KOL marketing in 2020? Have you had any breakthroughs? Any regrets? What have you learned from your experiences? What are the good KOL marketing case studies in 2020?

A year passes quickly, so it’s important to have a moment of reflection as it comes to an end, in order to better move forward and develop improved strategies in the new year.

Today, PARKLU is rounding up the most impressive KOL marketing case studies of 2020. Hopefully, everyone can take something away from these branding success stories.

Proya: Leveraged short videos to sell out of face masks

In July, the launch of Proya’s “Black Sea Salt Bubble Mask” sparked a lot of interest on short video platform Douyin. Millions of fans clamoured for the product, quickly sending it to number one on Douyin’s beauty and skincare list.

Why was this so successful?

- The product was both interesting and ubiquitous

Everyone was talking about the Black Sea Salt Bubble Mask—and it’s easy to see why. It has a fun and unusual selling point: About one minute after the mask is placed on the face, small bubbles start to pop out of the mask. The bubbling process is accompanied by a sound reminiscent of Pop Rocks. As more and more bubbles pop up, consumers have the satisfying sense that the mask is actually sucking the dirt from their pores.

- Product effectiveness for specific problems

The product’s standout features include removing blackheads, reducing shine and brightening skin tone. By directly addressing users’ pain points, the company is able to sell more products.

- The brand cooperated with a large number of mid-tier KOLs to promote the product

Proya not only cooperated with top KOLs on Douyin, but also chose to cooperate with a large number of mid-tier KOLs. For example, Proya worked with KOLs like @柚子cici酱, @乃提 Guli and other top-tier influencers with a price of around RMB 100,000 on Douyin’s Star Map platform (which helps match up brands and KOLs for collaborations). But they also worked with mid-tier KOLs in the RMB 30,000-50,000 range on Star Map, including @GGG, @大头表妹, and others. The brand has also selected a large number of male KOLs to expand promotions to reach a wider range of consumers.

JD.com’s fashion crossover with Chi Zhang

On 18 February 2019, JD.com teamed up with independent designer Chi Zhang to unveil a crossover fashion collaboration for JD.com’s e-commerce sale. The crossover saw Chi Zhang launch a play-themed series of limited-edition streetwear. The company also worked with fashion media, tech media, fashion influencers, and celebrity KOLs on a multimedia publicity campaign and held a fashion show offline.

In order to break consumers’ conventional perceptions, JD.com took an out-of-the-box approach with this fashion crossover, by doing a series of millennial and Gen-Z-focused fashion capsule collections based on the idea of “playing without playing”, specifically exploring youth lifestyles in a digitally connected world. These garments designed with Chi Zhang drew inspiration from computers, gaming, SLR photography, music, and more.

The Weibo topic #玩所未玩# attracted fashion bloggers @肥西肥西, @LOKI乐熙, @混搭女王 and others to participate in the discussion, reaching a total 110 million reads and 178,000 discussions.

M.A.C. Does Gaming with Honour of Kings Collab

Makeup brand M.A.C. executed an IP crossover with the gaming and celebrity world with the goal to attract new Gen Z customers. On January 8, the brand joined forces with the popular game Honour of Kings and the girl band Rocket Girls 101 from reality TV show Produce 101 to create a marketing campaign titled “Kiss, We Can Win.” M.A.C. launched a line of limited edition lipsticks and invited five members of Rocket Girls 101, including Wu Xuanyi, Meng Meiqi and Lai Meiyun, to use M.A.C. makeup to portray characters from Honour of Kings. Customers could also customise exclusive tubes of lipstick according to their own personal preferences.

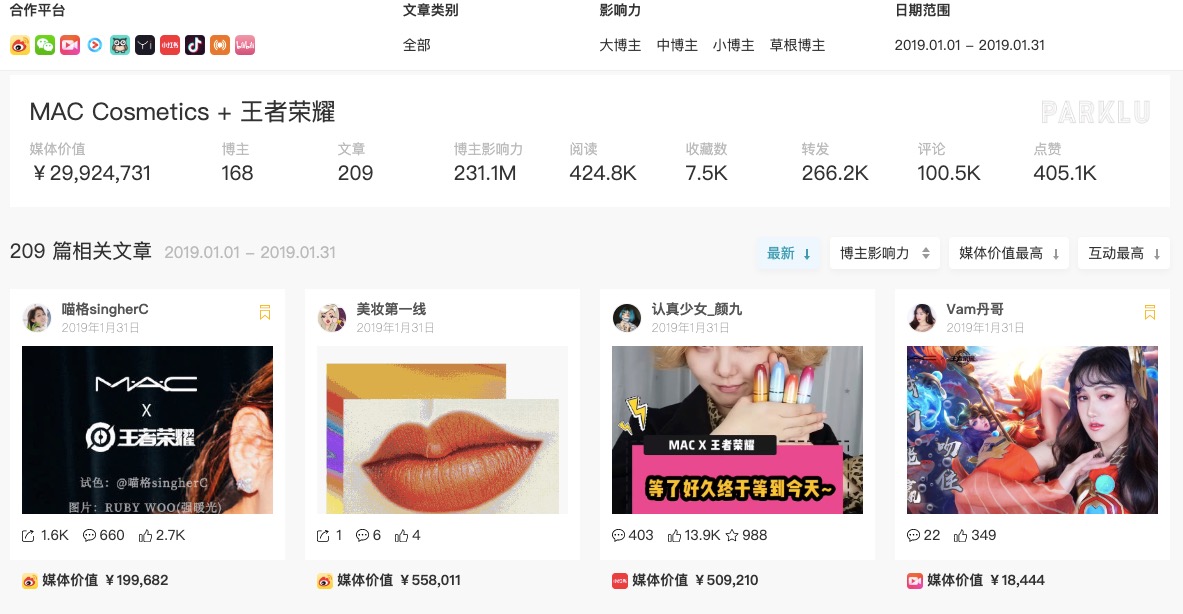

M.A.C.’s WeChat mini-program pop-up store sold out of the lipsticks in just one hour. Analysis of data from the PARKLU KOL marketing platform revealed that throughout January, the initiative was mentioned by 168 bloggers in 209 posts on Weibo, Xiaohongshu, Douyin, and other social media platforms, with a total of 779,000 interactions, creating a media value of 29.92 million.

Li Jiaqi and Wei Ya boost live stream promotions

From 15,000 lipsticks sold in five minutes to a head-to-head sales contest with Alibaba founder Jack Ma, Li Jiaqi was on fire in 2020! In less than three years, Li Jiaqi has gone from a monthly salary of RMB 3,000 to annual earnings of RMB 10 million.

Li’s success comes with the rise of live streaming sales, which is growing rapidly and bringing new opportunities and trends.

On Singles’ Day 2019, Li Jiaqi live-streamed for four hours for an audience of 30 million people. Hundreds of thousands of items in stock were sold out within three seconds. His success is largely due to his understanding of his users who are almost entirely women. The star spends most of his time researching his fans as well as understanding consumer psychology and sales techniques.

During 2019’s Singles’ Day festivities, at 23.00 on 6 November, “Taobao Sister” Viya (a.k.a. Weiya Huang) connected with Kim Kardashian for a live stream sale.

Kim Kardashian’s personal fragrance brand KKW established its presence in China simultaneously with its overseas flagship store going online, so the intention to break into a new market and sell products was very clear. With the help of Viya, 6,000 bottles of Kardashian’s perfume sold out in only 30 seconds. Even Kim herself appeared shocked.

Perfect Diary: Private Domain Traffic and KOCs

When the term “private traffic” is brought up, most can’t help but think of the “dark horse” makeup brand Perfect Diary, which is one of the best KOL marketing case studies in China. At the two Guangzhou offline experiential stores customer service reps guide customers to “friend” the brand’s WeChat account, and online orders were also be similarly asked to follow a WeChat account for additional benefits.

This WeChat account is presented as belonging to a real person called “Xiao Wanzi”. Her circle of friends is carefully managed, with two to three posts a day. The account looks like the day-to-day life of a girl who likes makeup. Xiao Wanzi will pull customers into the brand’s various communities. Xiao Wanzi also has a WeChat mini-program called “Wanzi Said” (“完子说”), which features content related to makeup skills.

After establishing this private traffic, “Perfect Diary” uses the Wechat Moments and the various WeChat communities to reach consumers, deploying various tactics including live streams, sales and lucky draws to secure conversions and repeat purchases.

Private traffic content covers the full range of consumer categories including e-sports, fashion shows, e-commerce live streams and more, which is conducive to deeper interaction between MCNs, creators, and fans, and social commerce platforms continue to focus on the development and operation of private traffic. Tmall launched its Flagship Store 2.0 upgrade plan in June 2020, and Tencent has also announced its new “.com2.0” retail model, while Pinduoduo and Yunji are also active in this space.

These are the five KOL marketing case studies that have attracted our attention in 2020 – hopefully, there’s food for thought for all brands from these examples

Leave A Comment