When marketers and brands come to China, they’re often blown away by the record-breaking numbers that always seem to be in the headlines for influencer success stories. From live-streaming phenom Viya helping Kim Kardashian sell out of 15,000 KKW fragrances in just five minutes, to beauty influencer Li Jiaqi selling the same amount of lipsticks in a short amount of time, these accounts are just a few of the examples of the selling power of influence. On the face of it, it’s unarguably impressive. And it’s tempting to believe there must be a one-size-fits-all approach to generating hundreds of thousands of RMB from Chinese consumers on Chinese social, video, and streaming platforms.

First, it is important to understand that the Chinese market is incredibly unique when it comes to just how consumers engage with their digital ecosystem in which KOLs play a major role. China spends more time on digital than any other major developing market, including the United States—Chinese consumers over 18 years old spend more than 58 per cent of their total time involved in Internet activity (including time spent on both desktop and mobile) compared to 54.1 per cent for US citizens and 54.7 per cent for those in the UK. This connected population is only getting larger every year, with a 6.8 per cent year-on-year growth compared to 0.3 per cent in the US. From 2018 to 2019, this translated to China gaining a whopping 57 million more internet users, while the US gained 1 million.

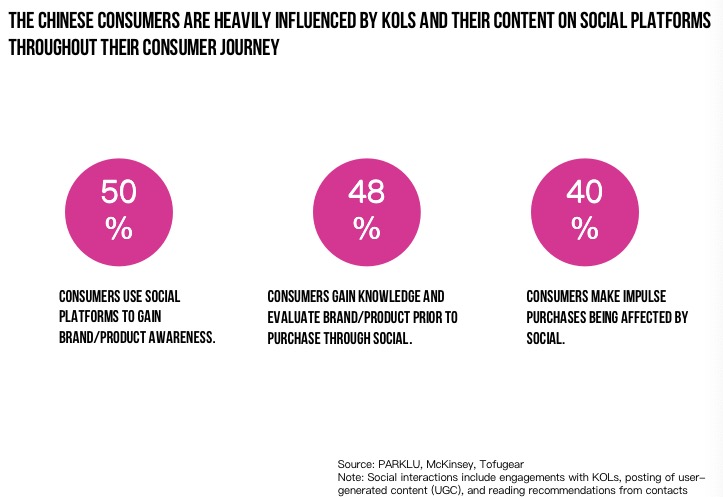

So we know that China’s Internet population is huge and getting bigger, but how do these figures apply to the KOL community? PARKLU estimates that about 50 per cent of Chinese consumers use social platforms—including following and engaging with KOLs, posting their own content, and reading recommendations from their friends’ circle—to glean more awareness about brands and products. Slightly fewer consumers, at 48 per cent, take this a step further and use social to learn, research, and evaluate a product before making a decision to purchase. Finally, about 40 per cent of consumers will make impulse purchases as a direct result of social media.

The stats are no doubt promising, but for those in the process of stitching together their China KOL strategy, it’s important to remember that there’s no special ingredient that guarantees a sale. In fact, brands should keep in mind that building relationships with fans through KOLs takes a great deal of patience, and the payoff and value for investment in an influencer often don’t translate to direct sales—at least not right away. However, there are a number of points to keep in mind that will help brands build a better picture of what inspires a Chinese consumer to engage with a product via a KOL. Part of understanding this is unlocking the secrets of how KOLs interact with their audience.

Hint: It’s all about the emotional connection between KOLs and Chinese consumers.

KOLs have established high levels of trust with Chinese consumers

Across the globe, the trust between an influencer and their followers is highly coveted by marketers and brands. This is the fuel that motivates the influencer economy, and the loss of trust can be to its detriment. But what exactly causes a consumer to trust a KOL more than they would trust a brand?

A lot of it boils down to authenticity. Consumers are going to place more faith in a KOL that creates authentic content than those who don’t. A rising number of KOLs will even sacrifice video quality to give their viewers a sense of them being their authentic selves.

Other factors behind the KOL-follower’s emotional connection include:

- Personalisation. A KOL’s followers look to them for guidance on how to live a certain lifestyle or be part of a niche interest group, and KOLs build this community through personalised, curated communications. A KOL knows their follower better than anyone else and is constantly interacting with their followers to build a better picture of what makes them tick and creating content that reflects their audience. KOLs are highly reliant on a fan’s comments and feedback and spend a significant amount of time answering questions and getting to know their followers on a personal level. Beauty influencer Melilim Fu says she goes as far as getting to know about her fans’ families and personal milestones, while Chengdu-based fashion blogger Sam Triplett told PARKLU that responding and reacting to comments and questions from fans can “make or break a sale”.

- Expertise. Sometimes trust is established by the KOL’s credentials. Whether they have direct industry experience or have otherwise built up a reputation for being an authority on the subject at hand, displaying expertise can build an invaluable connection with followers looking to influencers for guidance as they research a brand.

- Content. Trust and authenticity are often established by showing and not telling. Social media platforms with services like live video streaming give KOLs the unique opportunity to demonstrate in real-time how a product works, show off results of a product, or take viewers along on experience so that followers can judge with their own eyes whether or not a brand’s offering is a good fit for them.

- Guanxi. We saved the best for last. Guanxi is the Chinese concept of relationship building founded on the principle of reciprocity. It may not be immediately obvious how this translates to a KOL and his or her followers, but it comes down to this: the KOL delivers something valuable to their followers in the form of content highly tailored to their needs, interests, and aesthetic preferences. Although this content can be consumed for free, many Chinese consumers feel inspired to return the favour by supporting the KOLs via making purchases.

Influencers get some of the best deals

While trust has a major amount of weight in a KOL’s relationship with its fans, it’s also important for brands to consider just how much discounts are a factor for both the influencer and the consumer. According to a 2018 report from digital marketing and consulting firm Westwin on the behaviour of Chinese outbound travellers, product discounts were the second most important driver to purchase after influencers themselves, underlining just how useful discounts are as a sales tactic in the influencer marketing playbook.

KOLs often have the leverage to negotiate competitively low prices with the brands in order to ensure they’ll sell more products—this is especially the case with e-commerce Livestream sales. But this is not a strategy that works for every brand. Products that are suitable for discounts and promotions tend to be those that have the ability to be “viral” or they can be easily distributed as part of a limited offer or limited edition deal. In certain categories and for certain consumer groups, a product’s value or quality might be a more important purchasing motivator over price. For example, millennial luxury consumers tend to prioritise what’s “cool” over getting a deal, according to a recent report from Bain, while a recent Mintel survey reveals that 91 per cent of consumers think the quality is much more important than price.

Know your Chinese customer

This one may seem obvious, but it’s easy to overlook. While it’s true that Chinese consumers are often motivated to buy by the popularity of the KOL alone—take Li Jiaqi’s lipstick sales records as a prime example—it doesn’t mean brands should forget that varying demographics will often lead to different behavioural patterns that motivate a sale and thus differing emotional connections between a KOL and consumer. Brands should fine-tune their strategy beyond aspects like generational differences, but it’s a good place to start:

- Gen Zs. Comprising approximately 40 per cent of all Chinese consumers, according to a study by the Kantar Group, this generation is the first to have grown up entirely with the internet. They share many of the same characteristics as their millennial counterparts, but they’re more likely to make purchases directly on social platforms and more so than older millennials, they’ve grown up in relative comfort. Read more about some of the top influencers in this group here

- Millennials. The first generation to enjoy having disposable income in their youth, this cohort tends to be more carefree than their parents, but more pragmatic than Gen Zs. As this generation moves into adult responsibilities and parenting, they’re more likely to be prioritising their kids than they are themselves. Read about how brands have marketed to Chinese millennials now.

Reach an in-depth understanding of your KOL’s audience to know not only if your brand will click, but what will motivate Chinese consumers to engage with your products once brand awareness is established.

Leave A Comment