Alibaba’s Double 11 2020 events racked up a record-breaking RMB 498 billion in sales this year, almost doubling last year’s total. KOLs and celebrity influencers played a key role in driving sales to those new heights, with brands spending more than ever on partnerships.

The main reason this year’s sales tally eclipsed Double 11 2019 was that this year’s event spanned 11 days, running from 1-12 November rather than the usual 24-hour shopping fest. In fact, Double 11 2020 really started three weeks early this year, with pre-sales opening on 21 October with a curtain-raiser featuring live-streams hosted by top stars including Li Jiaqi and Viya Huang. Li Jiaqi’s live-stream was viewed by 154 million people, with Viya’s drawing 131 million viewers.

The pre-sales live-streams on 21 October returned outstanding results that outpaced 2019 figures. In the first ten minutes the event had eclipsed the entire first-day sales volume of the preceding year. Sales in that ten minutes were four times higher than the first ten minutes in 2019. In the makeup category alone, 12 products achieved over RMB 100 million in only one hour. Those included gift sets, electronic devices, cosmetics and skincare products from the likes of Korean beauty brand Whoo, Japan’s Yaman, Tripollar and Shiseido.

Unsurprisingly, consumer buzz around Double 11 is also starting earlier than ever. Data showed that searches for keywords related to Double 11 2020 grew steadily throughout September and early October. However, search activity exploded into life around 19 October, right before the first day of pre-sales on 21 October.

So what can brands learn from Double 11 2020? Here are a few of the key takeaways.

Brands are allocating more Double 11 budget to KOL collaborations

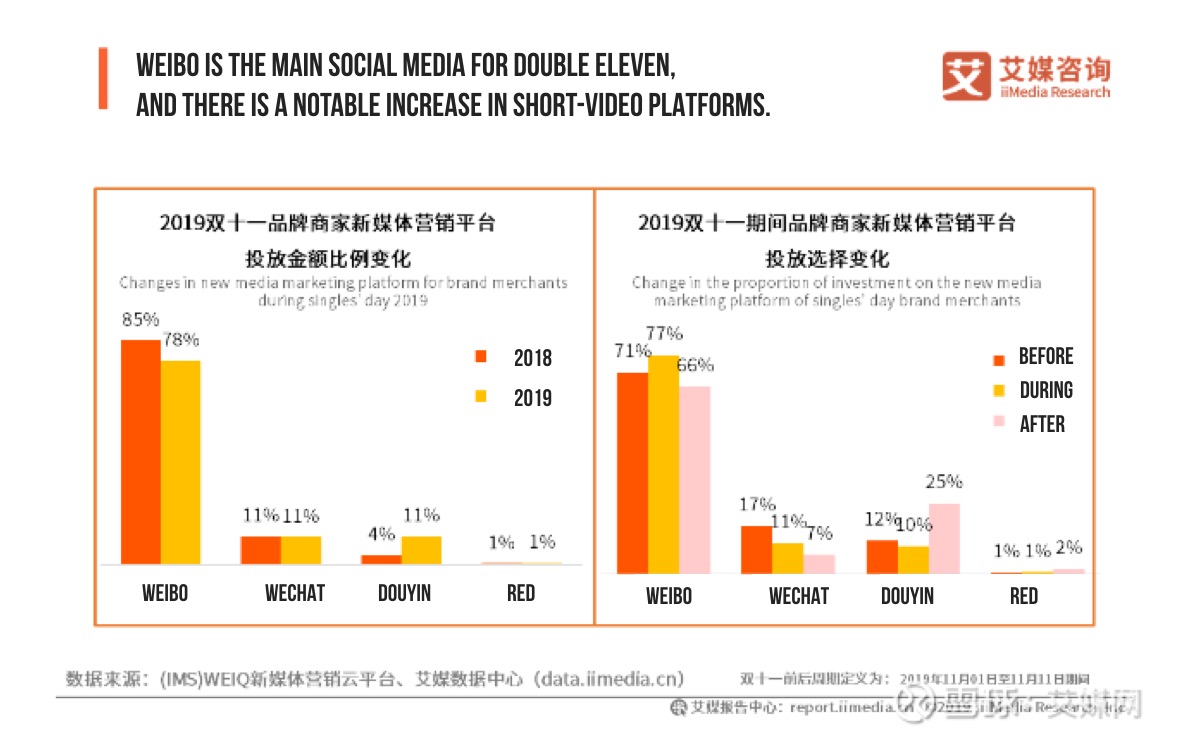

Over the past year, brands have consolidated even more of their promotional budget for Double 11 on KOL marketing collaborations. Data from iMedia shows that brands were allocating budget to 57 percent more KOL accounts during 2019 Double 11 than the previous year—and it’s likely this trend is continuing into 2020. The lion’s share of that investment went to Weibo accounts both in 2018 and in 2019, but there was a notable increase in spending on Douyin influencers in 2019, reflecting the growing importance of short video platforms. Short video accounted for almost 40 percent of the Double 11 content pushed out by brands last year.

Every social platform has a Double 11 spinoff

Alibaba’s Double 11 events are the central attraction, but an ecosystem of e-commerce festivals has sprung up around Taobao and Tmall’s events, with pretty much every social platform getting in on the act. A variety of celebrities and KOLs, including stars like Lin Gengxin, Meng Jia, and Meng Meiqi, turned out to promote Double 11 sales on Weibo, and JD.com’s rival event is well established at this point.

Douyin held its own “Chongfen” e-commerce festival from 25 October to 11 November, including an appearance by Luo Yonghao. Kuaishou held a star-studded gala event on 30 October, with its own “116” shopping festival that ran from 31 October to 11 November. Rising star Pinduoduo also debuted its entry into the November e-commerce wars with a gala on 11 November.

New products are on top of consumers’ Double 11 2020 wish-lists

New products are a central focus of consumers’ attentions during Double 11 and this year was no different. New releases accounted for one in six transactions completed during Double 11 2020. Twenty new products broke the 100 million sales barrier this year, with over 350 hitting the ten million mark. This is not new – in 2019, new products accounted for 50 billion transactions during the entirety of Double 11 – but the trend is as strong as ever.

KOLs and celebrities participated in a series of Tmall live-streams introducing new products to consumers. The shows ran over a number of days in the pre-sales period, with A-list names including Huang Xiaoming and Yang Mi showing up in front of the camera.

Case Study: A Double 11 campaign calendar for Xiaohongshu

Brands start building momentum from early September through early October. In this period, brands will partner with KOLs and KOCs, testing different content approaches. This has the two-fold effect of giving the brand the chance to experiment with content and evaluate the user response and engagement, but also to expose consumers to the brand’s products without explicitly pushing the sales angle. This early exposure gives consumers space to organically develop curiosity and desire to purchase, and time to research the product before the Double 11 season gets into full swing. Brands should allocate around 30 percent of their Double 11 budget on this period.

The month of October is the “sprint” period on Xiaohongshu. From 1-20 October, brands will leverage mentions in the platform’s “notes” – via both professional KOLs and “amateur” KOCs – to cultivate consumer interest and drive sales. From 21 October to the end of the month, the campaign switches into pre-sales mode, pushing out links to e-commerce sites to aggressively drive sales. Budget allocation should be stepped up to around 35 percent in this phase.

Before Double 11 approaches, brands get more hands-on, using keywords to maximise conversions as consumer activity around 11.11 reaches a fever pitch. The brand is pushing out content in this critical stage, to make sure that consumers searching for products will turn up recent content. Around 30 percent of the budget should be allocated here.

Before Double 11 approaches, brands get more hands-on, using keywords to maximise conversions as consumer activity around 11.11 reaches a fever pitch. The brand is pushing out content in this critical stage, to make sure that consumers searching for products will turn up recent content. Around 30 percent of the budget should be allocated here.

Finally, as the excitement is subsiding, 13-15 November is an important opportunity particularly for small and medium-sized businesses, who can scoop up traffic and sales from keywords in a less crowded field. The remaining 5 per cent of budget should be held back for this final step.

Case Study: Swarovski’s celebrity-branded, limited-edition products

Swarovski launched a limited-edition gift box with spokesperson Wang Yibo, one of the most sought-after celebrities of the year when it comes to brand endorsements. The gift box was explicitly designed to capitalize on Wang’s popularity, and the gambit worked – the video on the brand’s official Weibo page clocked up over 5.5 million views, achieving 530,000 reposts, 6,000 comments, and 42,000 likes.

Case Study: KOL pre-sales live-streams help consumers do their research

As part of the extended pre-sales warmup, Tmall brought in celebrities and KOLs to recommend beauty products. Consumers could search these influencers’ names on Tmall to find and buy the recommended products. A procession of influencers including @白敬亭, @赵丽颖, @菊婧祎 and @杨越 participated, and by October 27 the Weibo hashtag associated with the event had garnered 2.19 billion views and almost 16 million discussions.

This tactic may seem like bread-and-butter KOL marketing, but it’s particularly vital to activate that combination of celebrity influence and word-of-mouth buzz in the run-up to an event like Double 11, when consumers will be overloaded with input and choice. Chinese consumers typically research purchases in detail, but during the Double 11 period they’re likely to be overwhelmed. By engaging influencers to explain the product, they are effectively “doing the homework” on behalf of the consumer. The trust the consumer has in a favourite KOL will be sufficient to compel them to commit to a purchase.

Case Study: Tmall Haofang’s lucky draw promotions

Tmall used Double 11 2020 as an opportunity to promote its new real estate sales platform, Tmall Haofang. Tmall partnered with real estate services company E-House, real estate and home furnishings e-commerce platform Leju and electronics giant Suning to launch the platform, aiming to build a comprehensive service where home-buyers can research, tour and get financing for property online. During Double 11, Tmall Haofang created discussions around its hashtag and ran a series of lucky draws where contestants could win a home for life, a year’s stay in a home, the equivalent of a year’s rent and more.

Leave A Comment