As ad-supported media content declines globally, media companies and brands scramble to find solutions to make up lost profits. Chinese companies have found theirs, and it blurs the line between content and commerce. It’s called retailtainment.

In the West, platforms like Instagram and Snapchat are actually starting to follow China’s lead by trying to implement content-to-commerce functions. Yes, that’s right: Western tech companies are copying China. However, they are still nowhere near as advanced in terms of functionality and market adoption.

“Retailtainment” might sound strange to Western internet users. While we’ve accepted that social media platforms will have e-commerce aspects, most of us have never considered that e-commerce platforms could become social and entertainment channels in their own right by fully integrating social content-to-commerce features.

Imagine a QVC-esqe live show on Amazon.

Well, this is the type of melange that has seen great success in China for quite some time.

Taobao, Tmall, and JD

Taobao, Tmall, and JD.com, China’s e-commerce titans, are at the forefront of online retailtainment with their built-in live streaming platforms Taobao Live, Tmall Live, and JD Live.

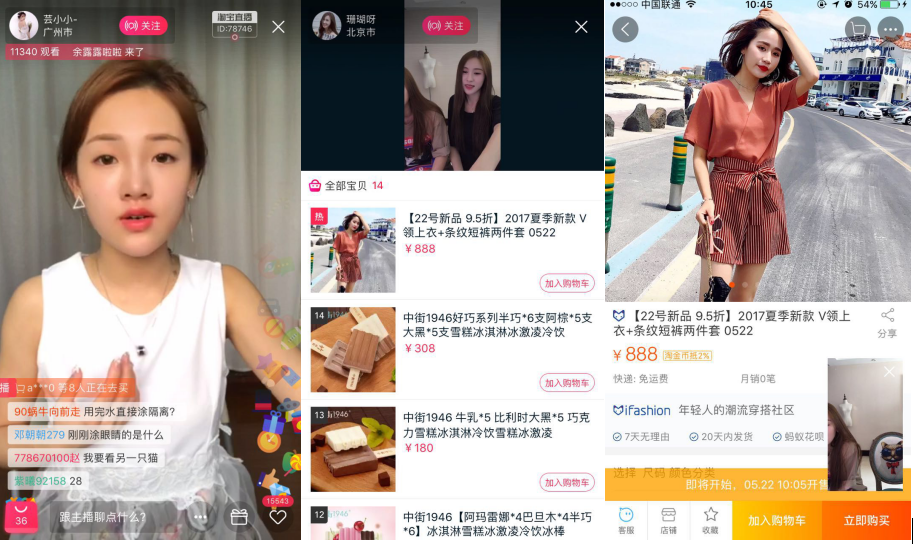

Live shows on these platforms are similar to QVC or a YouTube haul video, with streamers demonstrating products and answering audience questions. Shows can be hosted by huge brands like Audi and Maybelline or by individual streamers.

These streams have become incredibly popular.

Between August 17 and September 17 last year, nearly 35 million people watched live-streams on Taobao. One reason for their growth comes from the fact that live streaming provides the trust and transparency that China e-commerce traditionally lacks, with consumers discovering new products in real time.

This discovery-through-entertainment experience solves a key pain point for traditional e-commerce sites, which tend to take the serendipity out of shopping — they’re good for when you know what you want, but not so good when you don’t.

Retailtainment allows consumers to make purchases directly from the brand while simultaneously consuming their entertainment or educational content.

Taobao has experimented with other forms of retailtainment besides live-streaming.

After they saw that traffic peaked every day from 10-11 p.m., Taobao decided to mix video advertising and shopping with a little light entertainment, creating a series of webisodes.

The 2016 food-focused series, called “One Thousand and One Nights,” was a smash hit.

One webisode prompted consumers to buy 537,000 dumplings in just a few hours. In early 2017, Taobao continued the project with another series titled “Night Warriors”.

RED (Xiaohongshu)

All of China’s major e-commerce platforms have added retailtainment elements. However, the purest form of retailtainment in existence is the app RED (also referred to by its Chinese name, Xiaohongshu).

RED is the largest and fastest growing social e-commerce app in China with over 60 million registered users. It is a word-of-mouth marketing platform where consumers can discover and buy international products based on trusted user-generated content, including recommendations and reviews. Those come from the personal experiences of community members. Its most popular items include foreign cosmetics, beauty supplies and health products.

RED blurs the line between social media and e-commerce: It’s a social platform built around discovering new products and sharing reviews, yet is also an e-commerce platform where people directly purchase products seen in those reviews.

Amazon’s Feeble Attempt to Catch Up

You might be thinking, “Hey! This RED thing sounds a bit like Amazon Spark.”

(That is if you have even heard of Amazon Spark.)

Amazon’s Spark platform, which is eerily similar to RED, appears to be a weak attempt at catching up to China’s social e-commerce trends. Spark, which launched in July 2017, is a social feed of photos similar to Instagram or Pinterest where people can post photos and link them back to products found on Amazon.

While the concept has potential, Spark isn’t getting off the ground.

One reason for the slow adoption rates is that Amazon has essentially made it a closed platform, open only to Prime members. Nonmembers can view the feed, but they can’t post.

Another reason: Amazon is doing very little to promote the platform.

To be honest, I was unaware of Spark until I started doing research for this article. In a recent piece from Digiday, one influencer sums it nicely.

“Not a single person I know is using it. Why should I?”

Influencers are Crucial to Retailtainment Success

The result of retailtainment initiatives are much stronger when influencers and celebrities are involved.

A recent study from research firm L2 Inc. found that mass-market beauty brands earn an average 3.8 million interactions when live streams include celebrities and 476,534 interactions for live-streams with influencers, compared to only 141,121 for content without any famous figures.

In a typical influencer marketing situation, an influencer or celebrity will create content, which will then be posted on social media with a link to the e-commerce site. But now, many brands in China are collaborating with influencers directly on the e-commerce platforms themselves.

This means that instead of going to a social media platform to view content from their favorite celebrities and influencers, consumers are going to e-commerce platforms. The dynamic modifies users’ potential purchase mindset.

This is a huge development for performance-based influencer campaigns.

In an example from June 2016, milk formula brand Illuma invited Chinese actor Wu Chun to host a live stream on Taobao Live. In the 1-hour stream, the brand sold over 1.2 million RMB in products.

And only a couple weeks ago, supermodel Miranda Kerr launched her luxury skincare brand KORA Organics’ Tmall store in China via live stream from her Hollywood home. The event attracted over 223,000 live viewers, with KORA Organics offering exclusive giveaways for spectators.

Chinese mega-star Fan Bingbing has become very active on RED and has over 7.3 million fans. Known for her style and youthful appearance, Fan Bingbing uses the platform to share her favorite fashion and beauty products. In early March, she used RED to announce and promote her own line of beauty products.

While Western developers and marketers may be hesitant to overtly mix business with pleasure, Chinese consumers are embracing this new era of retailtainment. China has proven what’s possible, now it’s up to Western brands to change their mindset.

Leave A Comment