With the short video industry very much in the limelight, there have been gains for all kinds of content verticals within the various Chinese short-video apps. Everyone is tipping 2021 to be the year of the short-video, but with so many Chinese short-video apps to choose from, how should brands use the format to market their products? Will they find their audience on Douyin or Kuaishou, Watermelon or Bilibili? And which platforms are best for e-commerce? Let’s break down the pros and cons of each of these burgeoning Chinese short-video apps.

Douyin

Platform Features

User profile: The user base leans heavily towards young people, mostly relatively affluent women. On 6 January 2020, the Bytedance-owned platform (equivalent to TikTok outside of China) released its annual report showing that it reached an impressive 400 million daily active users.

What’s the content like? Music-inspire videos remain the stickiest content on Douyin. Though the content evolved quite a bit in 2020. It’s not uncommon to find videos under five minutes with robust narratives. According to an official announcement from the platform at this year’s Douyin Creators Conference, the most popular content area features vloggers talking about their day-to-day lives. This type of content accounts for up to 21 per cent of all content on the platform.

How is content distributed? When it comes to a video’s lifespan, Douyin’s recommendations algorithm facilitates a slow-burn dynamic. The videos a user is served up today may, in fact, have been published a long time ago – as long as users engage with a piece of content, it will continue to spread further and wider.

Brand collaborators: Douyin is popular with big-name brands such as Adidas, Audi, Michael Kors and many more.

E-commerce links: In addition to Douyin’s native e-commerce platform, videos can link directly to e-commerce platforms such as Taobao, Jingdong and more.

New features: Short video could become increasingly less short, as Douyin has been beta testing the maximum length of videos on the platform to as much as 15 minutes.

Additional notes: The comments section on Douyin is sometimes more interesting than the videos themselves. Brands should not overlook or underestimate the potential marketing power of the comments section, especially the landing page component of the comments section.

Drawbacks

No matter the size of a KOL, each video is subject to algorithmic-virality measured by engagement. So even a very popular KOL can produce videos that are duds. User interactions with much of the content are passive, and the platform’s power as a social network is relatively weak. On top of this, the cost of working with KOLs or running official campaigns on Douyin is very high.

Suggestions

Running product promotions with Douyin KOLs is a good way of generating interest and excitement among users. Product promotions on Douyin will typically prompt consumers to visit other platforms like Xiaohongshu to read reviews about the product, or to check out prices on Taobao before buying, so the path from promotion to conversion can be relatively long.

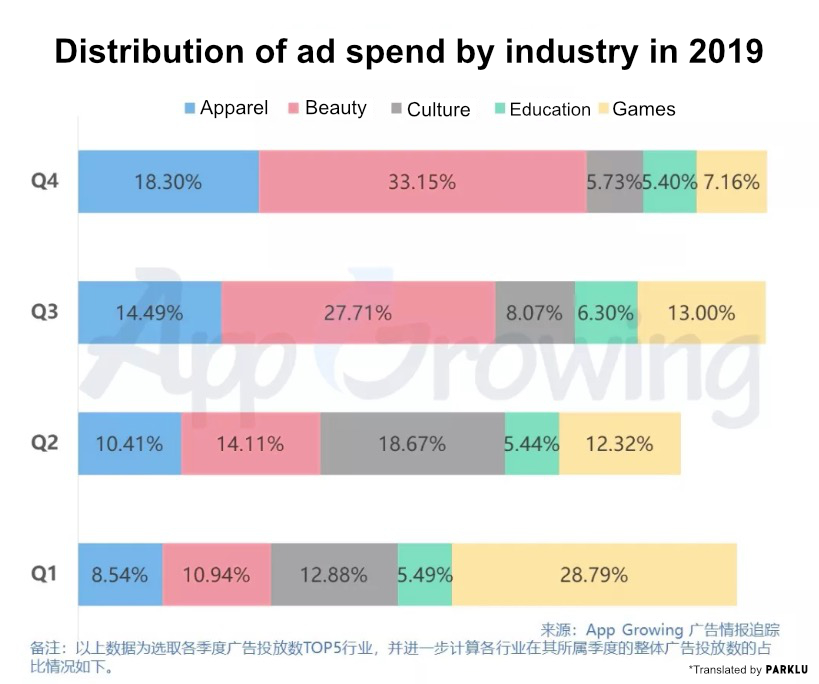

According to data from App Growing, the volume of advertisements on Douyin relating to gaming, culture, and entertainment declined gradually from Q1 to Q4 of 2019. However, the same period saw increases in advertisements for skincare products, beauty, apparel, shoes, and bags. So long as you remember that Douyin is typically only one touchpoint in the buyers’ journey, it can be excellent for awareness generation.

Kuaishou

Platform Features

User profile: Kuaishou’s user base divides relatively evenly along gender lines, with 54 per cent male users and 46 per cent female users. 64 per cent of the platform’s users live in third and fourth-tier cities and smaller towns and cities.

What’s the content like?

Because Kuaishou KOLs are primarily made up of communities of authentic consumers and micro-KOLs, as opposed to large scale KOLs and celebrities, the content has a very strong grassroots, raw feel to it. For instance, a lot of the content features home cooking or playing pranks on friends. However, the platform also has representation in beauty, skincare, and more.

How is content distributed? Kuaishou’s “Follow” page is the platform’s main content hub. As well as giving Kuaishou a genuinely “live” feel, the “Follow” page helps amplify KOL content, exposing influencer content to more users.

The platform’s users are also sticky, spending a lot of time on the platform. Compared to Douyin users, Kuaishou users are more generally more engaged, willing to not only “like” content from their favourite KOLs, but also to comment, and share.

E-commerce links: In addition to Kuaishou’s native e-commerce platform, videos can link to platforms like Youzan, Taobao, Kuaishou Xiaodian and others.

Drawbacks

As one of the most popular Chinese short-video apps, Kuaishou’s big disadvantage is a comparative lack of higher-quality user-generated content. The quality of content on the platform tends to be relatively low. In terms of commercialisation, the platform is still in its infancy, and its ability to monetise content is far weaker than Douyin.

Suggestions

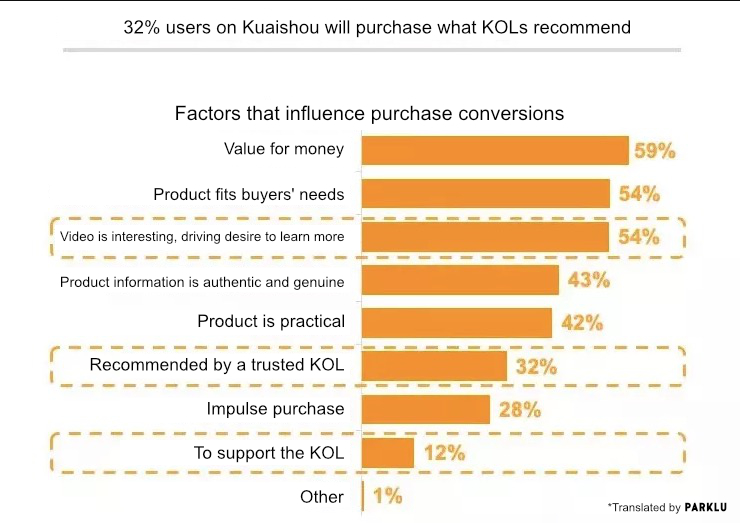

For faster conversions and to build private traffic, work with Kuaishou KOLs. Personal care brands are the biggest investors in KOLs on Kuaishou – and they see the best conversion rates. However, most of these are local personal care brands.

There are predictions that this year will see Douyin in decline and Kuaishou on the rise. One outcome could be that we’ll see international beauty and makeup brands promoting their products on Kuaishou, which could bring surprising results.

We’re also waiting to see if Kuaishou will invest more resources into supporting MCN agencies. Providing a better platform for MCN agencies will boost Kuaishou’s commercialisation process and help the company achieve more effective monetisation.

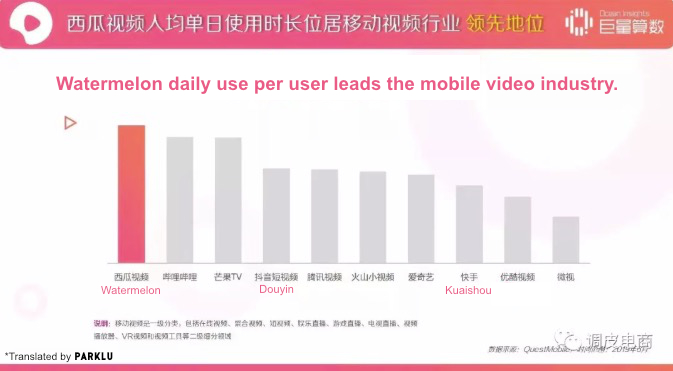

Watermelon

Platform Features

User profile: Males account for a relatively high proportion of Watermelon’s users, over 70 per cent of whom are under 40. Lower-tier cities are heavily represented in the Watermelon user base. Though the proportion of 18-30-year-old users increased by 4.4% in 2020 compared with the previous year, and the proportion of users living in higher-tier cities is also increasing.

What’s the content like? Like other Bytedance-owned products, including its forerunner Toutiao, Watermelon relies on the company’s powerful algorithms. The app is focused on delivering highly personalised algorithm-driven recommendations, and there’s no time limit on videos.

Watermelon attaches great importance to high-quality content and clearly provides support to this end. Both algorithmic recommendations and user sharing help drive traffic to high-quality content (especially videos longer than one minute long.

Brand collaborators: Collaborations covering the automotive industry, fashion, parenting, and dining have all proved very popular with viewers.

E-commerce links: Content creators can insert product links to e-commerce platforms such as Tmall, Taobao, daily deals platform Juhuasuan, JD.com and Koala.com.

Drawbacks

Watermelon hasn’t yet established a reputation for professionally produced content, partly because the platform also suffers from a lack of active big-name KOLs who can set the standard. A lack of creative content is another issue, and user “stickiness” is fairly weak.

Bilibili

Platform Features

User profile: Bilibili’s community skews younger than other Chinese short-video apps, with around 80+ per cent of users falling into the 16-25 age bracket. Most users live in first-tier cities, but in terms of consumer habits and socioeconomic status, users are evenly spread.

The average time spent daily on the platform exceeds 85 minutes, and on average 450 million videos are viewed every day on Bilibili. User engagement with the content is huge, with an average of 1.1 billion monthly user interactions.

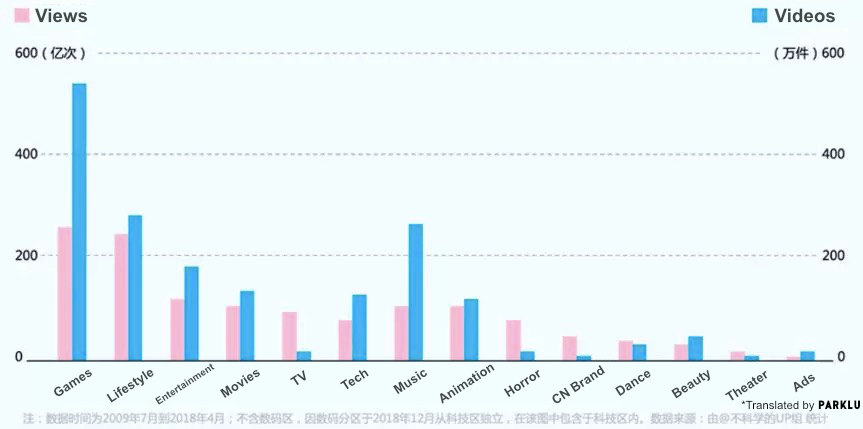

What’s the content like? Third-party data suggests that in addition to the platform’s traditional focus on gaming, Bilibili has also amassed enormous volumes of traffic around content areas with huge marketing potentials such as lifestyle, entertainment, film and television, beauty, and technology.

Brand collaborators: The strength of the Bilibili community means marketing campaigns on the platform can bring brands more engagement and retention. This is especially true for brands in the technology and entertainment industries, as well as what China calls “3C” brands (brands operating in the computing, communications, and consumer electronics spaces).

In addition to the 3C fields, content in the beauty segment also has considerable traffic and reach on Bilibili. At present, Bilibili is also trying to attract high-quality content creators in the fashion field, so we can expect fashion to become a big draw on the platform in the future.

E-commerce links: In addition to Bilibili’s native e-commerce platform, content can link to e-commerce platforms such as Taobao and JD. Links can be displayed as pop-up ads or in the text fields, or as purchase links and coupon links, allowing the user to jump to other platforms.

Drawbacks

Bilibili’s user demographics are rather narrow and limited to younger consumers compare to other Chinese short-video apps. Also, user-generated content on the platform is costly and time-consuming to create, and it’s difficult for many of the platform’s users to maintain a consistent stream of output. The high-quality creators who offer higher ROI also have tougher selection requirements.

Suggestions

Bilibili is currently the largest video-sharing platform in China, and the most common elements of Bilibili marketing include product promotion, in many cases through live broadcast combined with bullet comment interaction. Brands should consider crafting their bullet comments in advance and strategize when to send them in the video to build a stronger bond with their followers and viewers. 2021 will be a year of rapid growth for Bilibili, sure to bring countless opportunities for brands.

Final Thoughts on Chinese Short-video Apps in 2021

Thoughts from PARKLU’s CMO, Elijah Whaley: I don’t believe short-video is the future. I think everything is driven by innovation, and it just so happens to be that there is a lot of innovation happening around Chinese short-video apps at the moment. The truth is that short-video is a very challenging format for creators and consumers as it lacks the depth of storytelling and insights that typically makes content valuable. Not to say that brevity isn’t a value, it’s just shallow. This is one of the reasons we are seeing platforms like Douyin adopting longer-form video formats. But so long as innovation is being poured into short-video, creators and brands will have to do their best to entertain, inform, and persuade within 15 to 60 seconds.

If you want to stay ahead of the curve, I think it’s best to look at the future of co-created content, like that which we see in live-streaming and on Bilibili. I believe that engagement from the audience that further enriches the experience for everyone is the future.

Leave A Comment