When it comes to brand survival, a good quality product can certainly go a long way, but without loyal Chinese customers, it can only go so far. And unfortunately for brands, attracting loyal customers has never been more difficult, thanks to the ever-intensifying competition between companies with direct-to-consumer models and a seemingly unlimited array of social media and e-commerce platforms vying for shoppers’ attention. According to Nielsen, forty-four percent of FMCG brands say their biggest challenge is increasing Customer Acquisition Costs (CAC) and lower Customer Lifetime Values (LTV).

Chinese Customers: Buyer behavior

Of course, advances in CRM tech and AI have provided brands ample opportunity to access better data and craft more targeted e-commerce and marketing strategies. But brands don’t always have control over whether the marketing will have a lasting effect. When it comes to improving Customer Lifetime Value (LTV), what brands can leverage and control is how they interact with the Chinese customers they already have.

The alternative to this is a costly one. Compared to the West, new customers in China are already significantly more arduous to court because they need more touch-points—whether that’s reviews from fellow Chinese customers or KOLs, traditional advertising, product research, or something else—before committing to a purchase.

Increased CAC and lower LTV

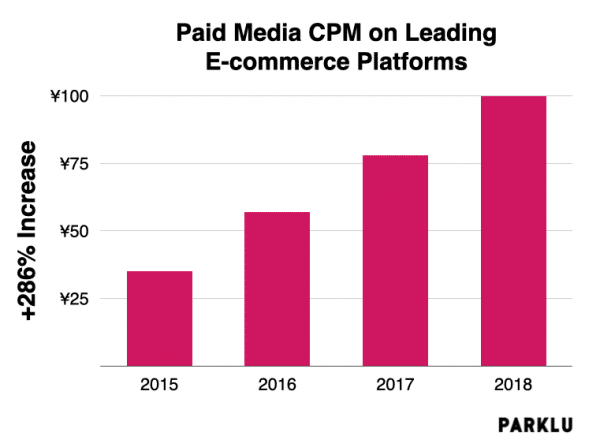

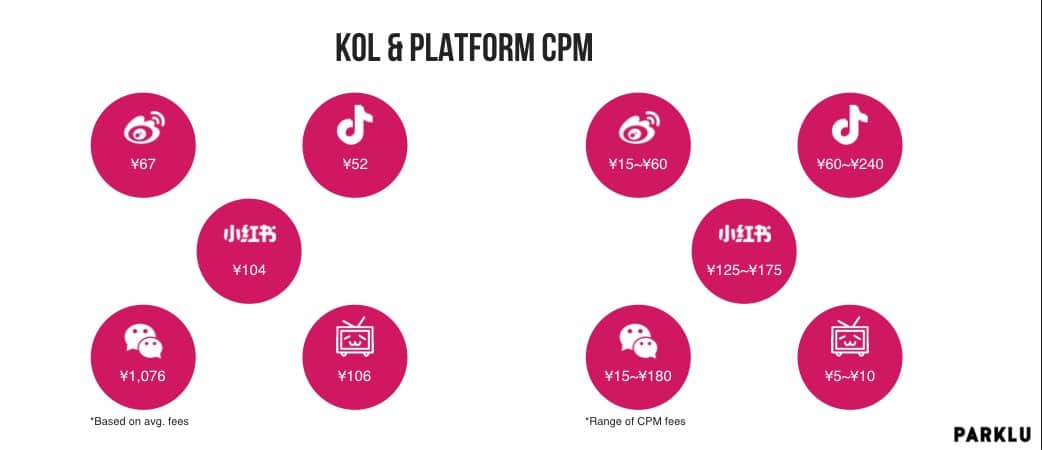

Then there are e-commerce ads, which, though important for driving conversions, have nearly tripled in cost on leading platforms between 2015 and 2018. KOLs are also an important touchpoint in buyer journeys, but these costs can also be difficult to justify and vary widely from KOL to KOL and platform to platform. Even when one platform lowers costs considerably, another platform will raise their fees—for example, in 2019, Douyin KOLs lowered their fees due to more KOL activity on its platform, while the average fee for a KOL on Xiaohongshu nearly tripled because of increased restrictions for content creators that year. The ROI generated from KOL marketing can be hit or miss when it comes to direct sales, and CAC can even outpace LTV in these cases.

And of course, while the live streaming craze has proved lucrative for many brands, this strategy comes with its own array of high costs and new sets of challenges, from getting the pricing right to making sure Chinese customers are going to buy again.

Guanxi: the key to customer retention

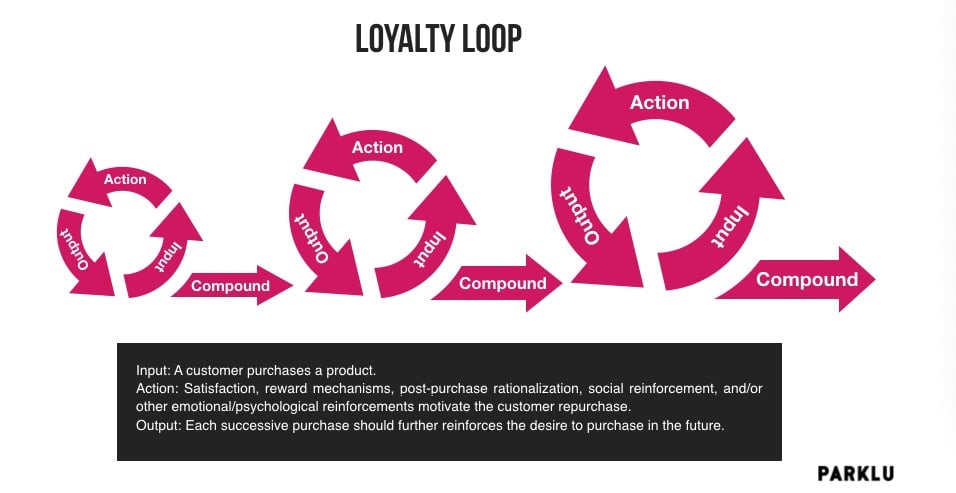

Luckily, brands do have avenues for offsetting these costs by improving and innovating on the ways they interact with their current Chinese customers. By investing in relationships with customers, brands can create a positively reinforcing cycle that compounds with each interaction.

Brands need to remember that retaining Chinese customers not only means generating loyalty among shoppers but creating highly supportive brand advocates. Leveraging cultural norms like guanxi are especially pertinent to the Chinese market. A social exchange mechanism built on mutual favors, guanxi in the context of brand marketing means constant communication of value propositions and trust built by reciprocity. In other words, if Chinese customers believe they’re getting something of value, they’re likely to return the favor through delivering their own value—feedback, reviews, and more.

Brands need to remember that retaining Chinese customers not only means generating loyalty among shoppers but creating highly supportive brand advocates. Leveraging cultural norms like guanxi are especially pertinent to the Chinese market. A social exchange mechanism built on mutual favors, guanxi in the context of brand marketing means constant communication of value propositions and trust built by reciprocity. In other words, if Chinese customers believe they’re getting something of value, they’re likely to return the favor through delivering their own value—feedback, reviews, and more.

Leave A Comment